I woke up, read my mail and saw these three quotes in an eMarketer email. They got me thinking fast.

You are an advertising agency. You worry about how to be digitally relevant in the next couple of years — or perish. Here are just three quotes from eMarketer that can act as thought starters. if these don’t start your mind, maybe its time to, um, bail?

By 2016 nearly a quarter of the world will be using location based services.

US online video ad spending will nearly triple in the next four years.

43 million Americans convert to using smart phones every minute.

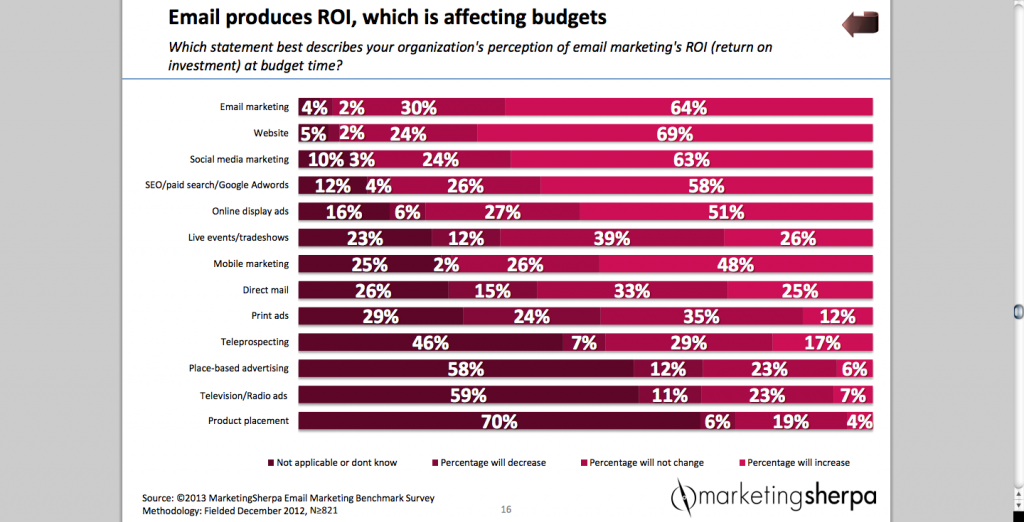

If you need one more idea, another path to agency success lies in the following eMarketer chart. And, no it isn’t rushing onto the Facebook or Twitter scrum.