“Are Advertising Agencies Cool Enough For Millennials?” is a Talent Zoo interview I just did with with Michael Donahue of the 4A’s. The interview discusses the millennial generation and how advertising agencies are going about wooing and keeping this younger generation of Mad Men.

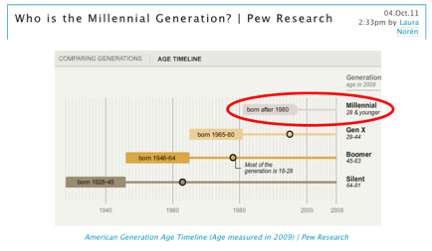

The interview got me thinking about the definition of Millennials, Gen X and Gen Y.

These are demographic terms that we seem to toss about but may not actually be clear about. So, to be clear(er)…

Gen X are the post-Baby Boomers born between 1965 and 1984. Gen Y and Millennials are essentially the same group and they were born between 1981 and 2000. These are the kids, you know the soccer playing, hip-hop listening, Brooklyn, Austin and Portland-bound, kids of the Boomers.

And for a lighter perspective, here is how BuzzFeed views the subject:

And for a lighter perspective, here is how BuzzFeed views the subject: