No question, one of the more wonderful shared Baby Boomer experiences has been paying for college education. I have two kids and they went to private four-year colleges. Cost? Tuition + food + housing + allowance = (?) lets say $450,000. Whenever I mention this to other parents, I get those wonderful all-knowing shared twisted smiles. I also love mentioning these numbers to my friends with younger kids. Yes, I am a sadist.

Now, don’t get me that wrong. I happily paid for my Kids to go to University of San Francisco and Bard College. There is absolutely no question that they benefited from their college experiences. As a business owner I interviewed lots of graduates. Many of whom couldn’t think critically, talk or write. My kids can actually do these things and do them very well. But, $450,000 makes me feel like an idiot.

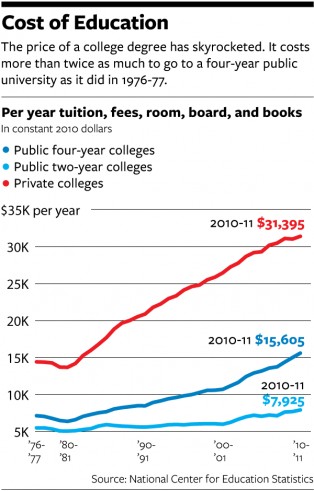

What really blows my mind is that our generation let the price of college go stratospheric. We allowed college administrators and faculty to over-design expensive campus buildings and over pay academics. The overall inflation rate since 1986 increased 115%. On the other hand, during the same time, tuition increased a whopping 498%.

What are the colleges really going to get for soaking us? Fewer students, jobs and even fewer colleges. Just as newspaper classifieds and record stores (remember them?) were disinter-mediated by Craigslist and iTunes, so will over-priced colleges get nailed by new online college competitors like Coursera. Coursera’s tagline? Take the World’s Best Courses, Online, For Free.